Beware of Time Limits for Car Accident Insurance Claims

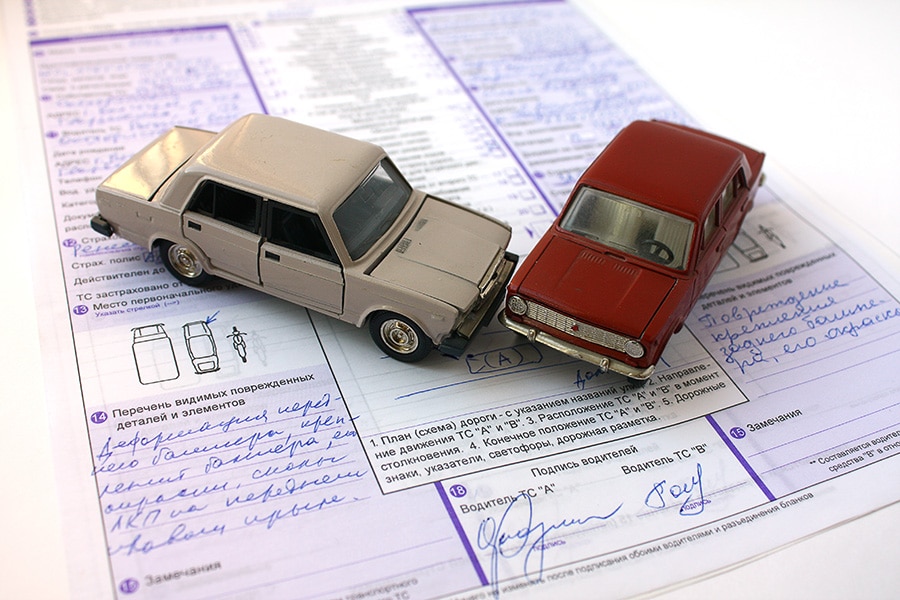

Car accidents are often terrifying experiences. People can be injured, vehicles may sustain serious destruction, and property damage may occur. But having proper coverage and a caring, professional insurance agent can make the situation a little easier to handle. Car Accident Claim Time Limits Every state has a time limit in which legal action must be taken to file a […]

Beware of Time Limits for Car Accident Insurance Claims Read More »